Personal Real Estate Corporations Part Two: Implications and Tax Incentives

Since the passing of the Trust in Real Estate Services Act, 2020 (“TRESA”) in October, licensed real estate salespersons and real estate brokers (“Agents”) have been able to imagine new possibilities for growth. The implementation of TRESA, allowing Agents to incorporate their business as Personal Real Estate Corporations (“PRECs”), providing Agents with appealing tax incentives and investment opportunities.

TAX INCENTIVES FOR INCORPORATING YOUR PREC

Before Agents decide to incorporate, they will need to evaluate whether PRECs are the right avenue for their personal and financial future. Though PRECs offer some alluring tax advantages, there is every possibility that your business does not necessitate incorporation. In fact, if you do not meet certain financial requirements, incorporating could hinder your economic development.

Agents that find themselves with excess cash at the end of each fiscal year may benefit from this new opportunity. But, ultimately, tax incentives and profits from your PREC are only advantageous for Agents bringing in excesses of $100,000 net income annually. Whether you considered saving for your retirement, growing your professional prospects, or selling your business in the future, incorporating your business can help you achieve your goals.

FINANCIAL ADVANTAGES OF PRECS

Tax Deferrals

Some of the most impressive innovations PRECs provide are tax deferral possibilities. PRECs allow Agents to leave a portion of their business earnings in their PREC rather than take as taxable income. In essence, PRECs allow you to defer personal income taxes into the future so to decrease financial burdens. This is especially advantageous for Agents whose annual income levels fluctuate. PRECs can be especially useful for Agents planning ahead for an upcoming sabbatical (i.e. maternity/paternity leave).

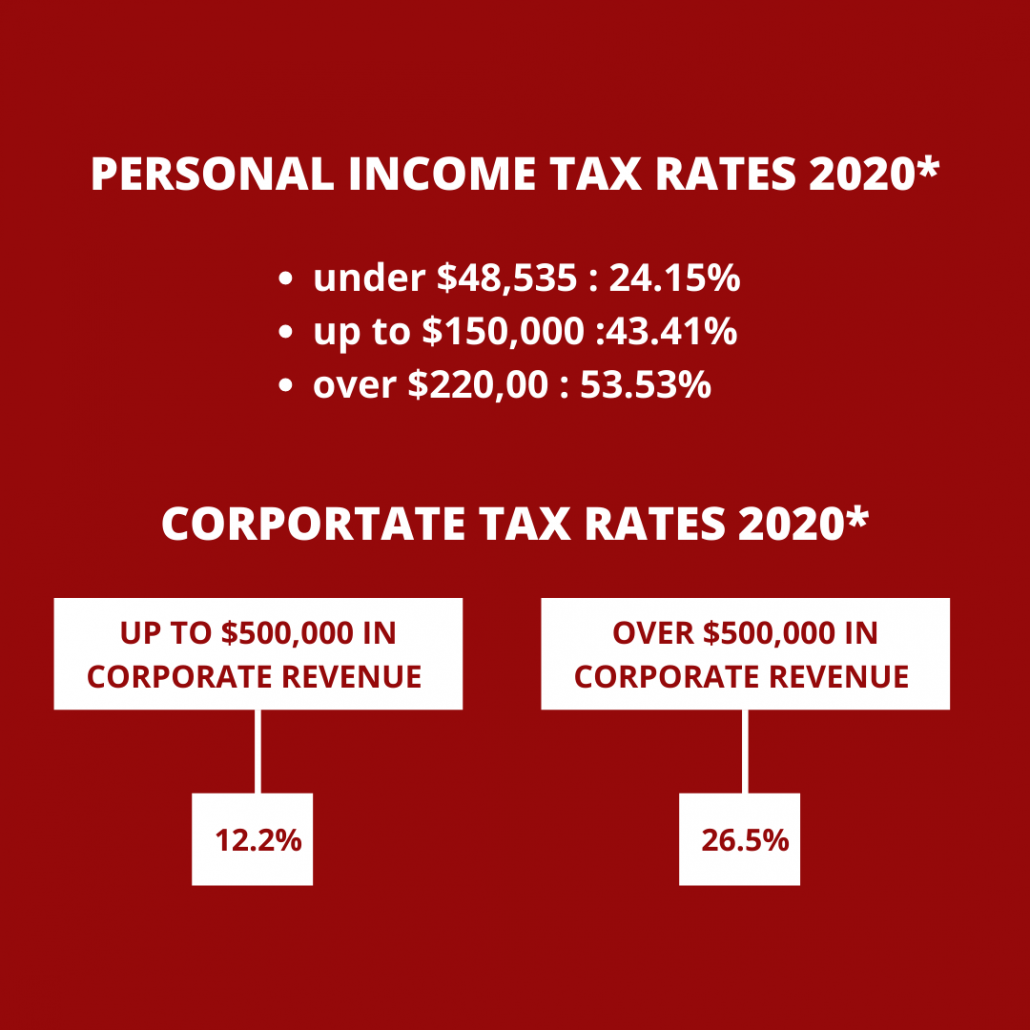

Because your PREC is a separate legal entity it will no longer be subject to your personal income tax rates. While personal income tax rates can reach 53.53% on active busines income over $220,000, your PREC will earn revenue independently wherein taxes are paid on income earned inside the corporation and are therefore subject to substantially lower corporate tax rates. Ontario’s Small Business Deduction allows for the lowest corporate rate of 12.2% (2020) on the first $500,000 of active business income. Thereafter, any income earned over $500,000 is taxed at 26.5%.[1]

Retained Earnings and Passive Investments

PRECs allow you to re-invest retained earnings, or passive income, inside and outside your corporation. For instance, excess funds can be used to hire employees, invest in advertisement opportunities, and/or purchase shares in another corporation, rental properties, or life insurance (“Passive Investments”). Further, a well-planned estate plan may allow for the transfer of ownership of the PREC to beneficiaries without encountering estate administration taxes. Contact us for more information and help setting up your Estate Plan.

Interestingly, though Passive Investments do not necessarily affect federal corporate tax rates, they can impact your ability to obtain Ontario’s Small Business Deduction when income levels reach in excess of $50,000. These “grinding” rules can lead to higher tax rates of 18.2% which, objectively, is still a marked improvement from 53%.

Self-Employed Agents

For self-employed Agents, PRECs provide more flexibility by allowing you to pay yourself by way of salary and/or dividends; however, note that funds drawn from the PREC in these forms may be subject to your personal income tax rates described above. Though a personal salary obtained from your PREC will likely be subject to Canada Pension Plan (“CPP”) contributions, such annual costs are not required for funds drawn in the form of dividends, specifically when in conjunction with a formal retirement plan. Further, Agents should keep in mind that receiving a salary and T4 can be advantageous as well, providing stability for your financial future and making it substantially easier to qualify for a mortgage.

Income Splitting

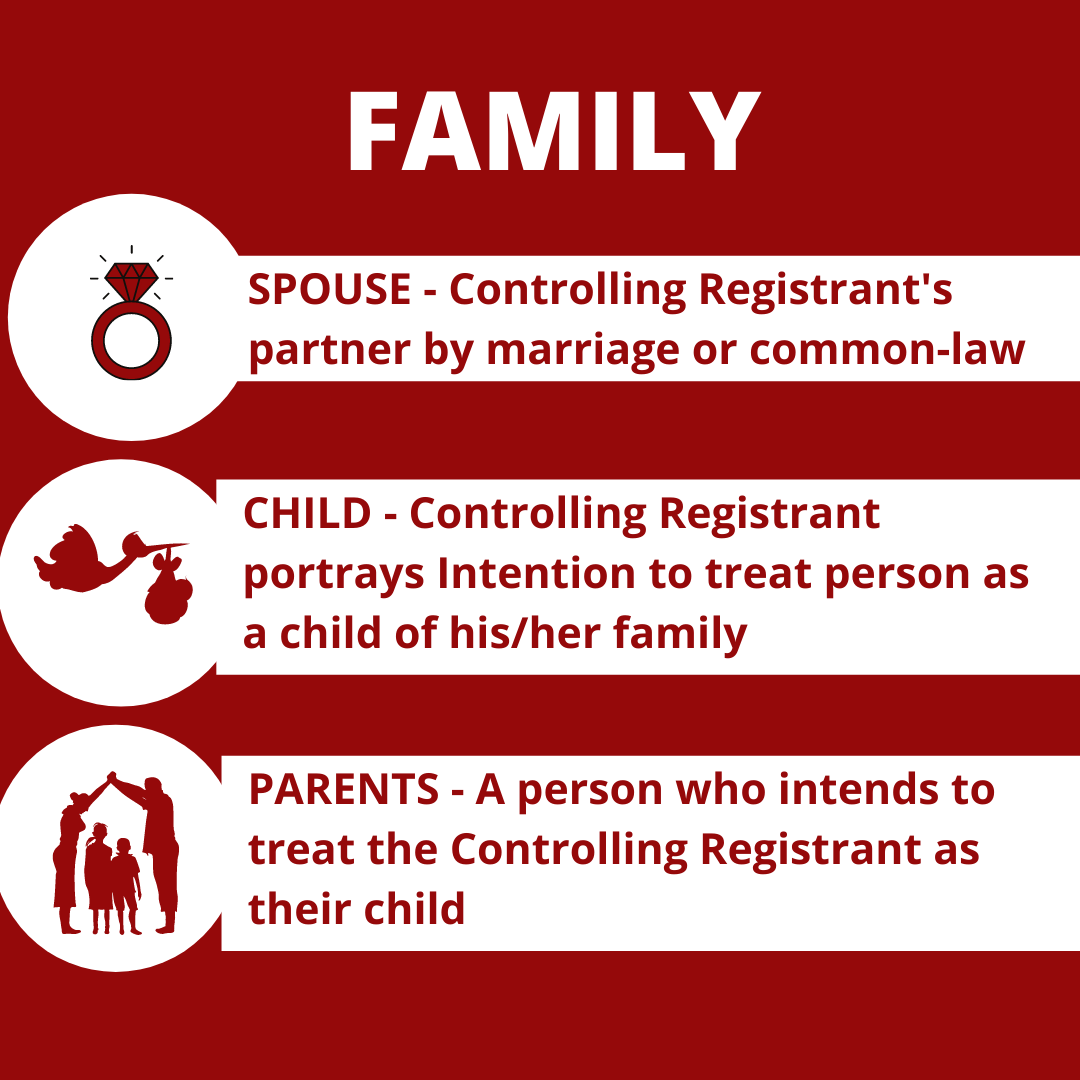

The corporate structure of PRECs also provide Agents the opportunity to split the business income with family members and/or employees to attain certain tax benefits. Income splitting can be accomplished by paying family members in dividends, in turn lowering your combined tax burden. But it can be a complicated process and there are limitations. Recipients of dividends for this purpose must be:

- defined as “family” per new TRESA amendments;

- actively engaged in the business carried on by the PREC on at least a part-time basis (20 hours/week or more);

- at least 18-years of age; and

- hold non-equity, non-voting shares in the capital of the PREC.

The Controlling Registrant should obtain advice from their accountant and/or financial advisor as splitting income can lead to additional imposed taxes for which the Controlling Registrant would be liable.

LIFETIME CAPITAL GAINS EXEMPTION

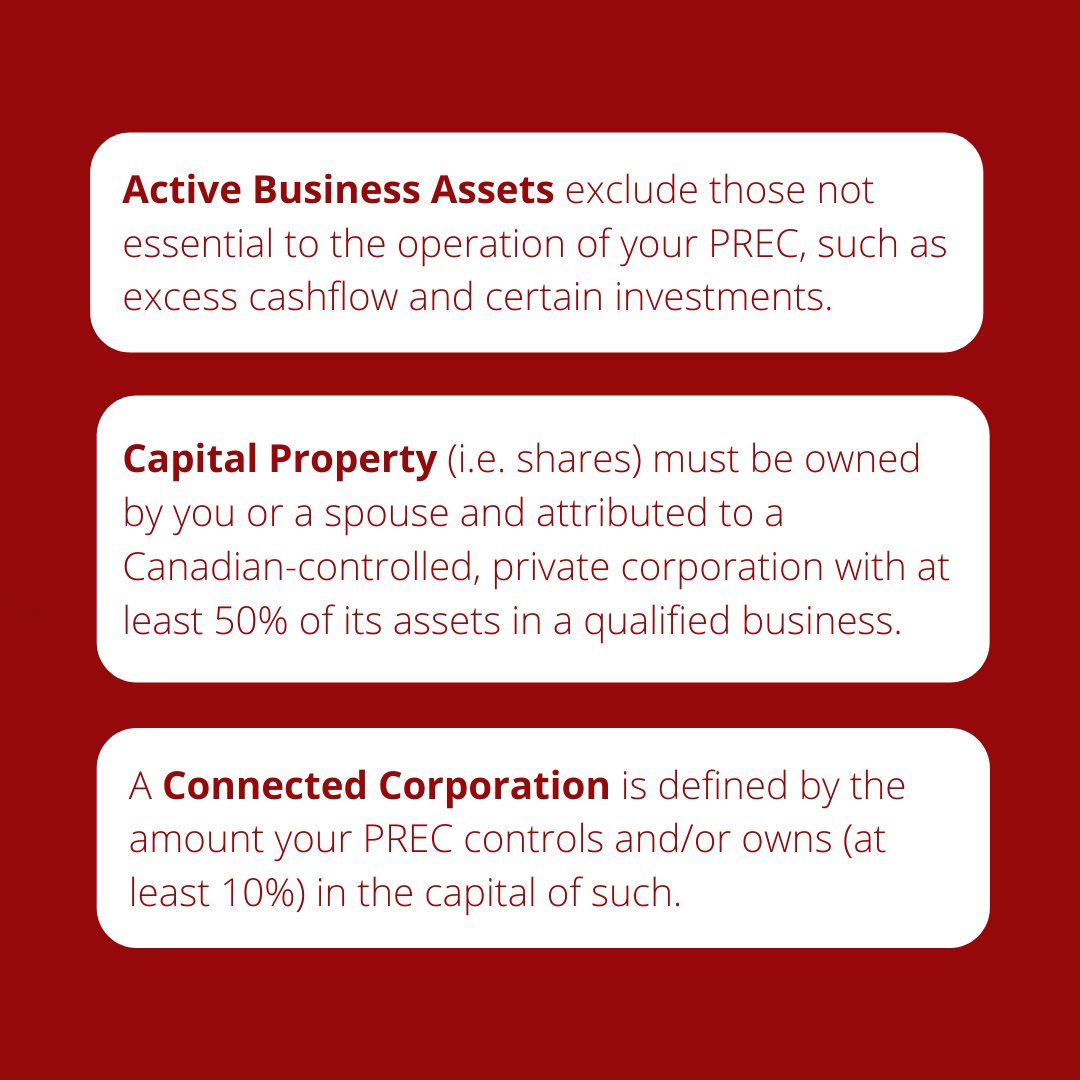

One of the greatest advantages of incorporating is succession planning. If eligible, your PREC may be entitled to Ontario’s cumulative Lifetime Capital Gains Exemption (“LCGE”). The LCGE is a once in a lifetime tax emption based on net gains realized on the disposition of Qualified Small Business Corporation (“QSBC”) capital property. This means that you could potentially sell your PRECs shares while sheltering such capital gains from taxes. Currently, the LCGE is $883,384, a figure that increases annually by 2%. Most PRECs can qualify but it is important to consider the necessary requirements and whether certain investment choices hinder your eligibility.

In addition to being a privately owned, Canadian-controlled corporation, to qualify as a QSBC your PREC must use at least 90% of its assets in connection to its active business and/or be attributed to capital property owned in a connected corporation. As with income splitting, you should consult with your financial advisor and/or accountant to ensure your PREC is structured correctly. For further information regarding corporate structure and post-incorporation considerations, we have a future blog coming soon called “Personal Real Estate Corporations Part 3: Corporate Structure & Liability”.

If you’re ready to take your real estate business to the next level, reach out to our corporate law staff at info@rabideaulaw.ca.

Please note, this article should not be construed as legal advice. You should obtain the advice of your legal representative, financial advisor, and/or accountant prior to incorporating a PREC.

* UPGRADE your package for $200 and we will apply for the corporate tax number, HST number and payroll number.