Personal Real Estate Corporations, Part Three: Corporate Structure & Liability

CORPORATE OBLIGATIONS

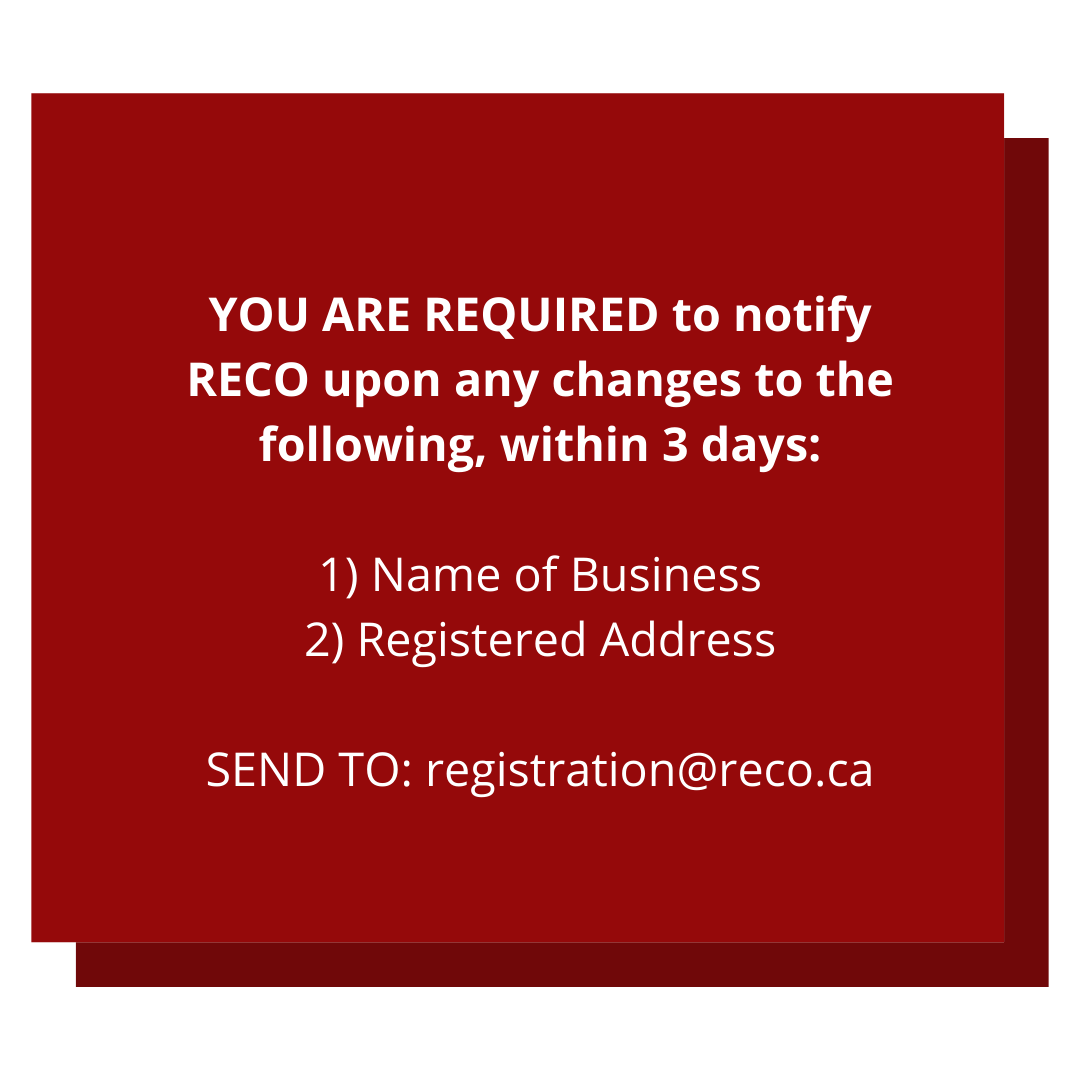

Currently, each Agent needs to meet RECO obligations and legislative requirements found in REBBA as well as the Ontario Business Corporations Act (the “OBCA”). The OBCA regulates everything from registration with the ministry and name choice to the form and paper quality of documents. Without the ability to interpret the Act’s contents in relation to REBBA and RECO regulations your PREC could be exposed to regulatory hearings, audits, and other liabilities. Meticulous bookkeeping is a necessity; your PREC must maintain accurate and current physical or electronic records. Agents and brokerages must ensure all obligations are met, including informing RECO of your PREC.

This is why Rabideau Law recommends that you discuss incorporating your real estate business with a qualified legal representative to ensure your PREC complies with both REBBA and OBCA requirements.

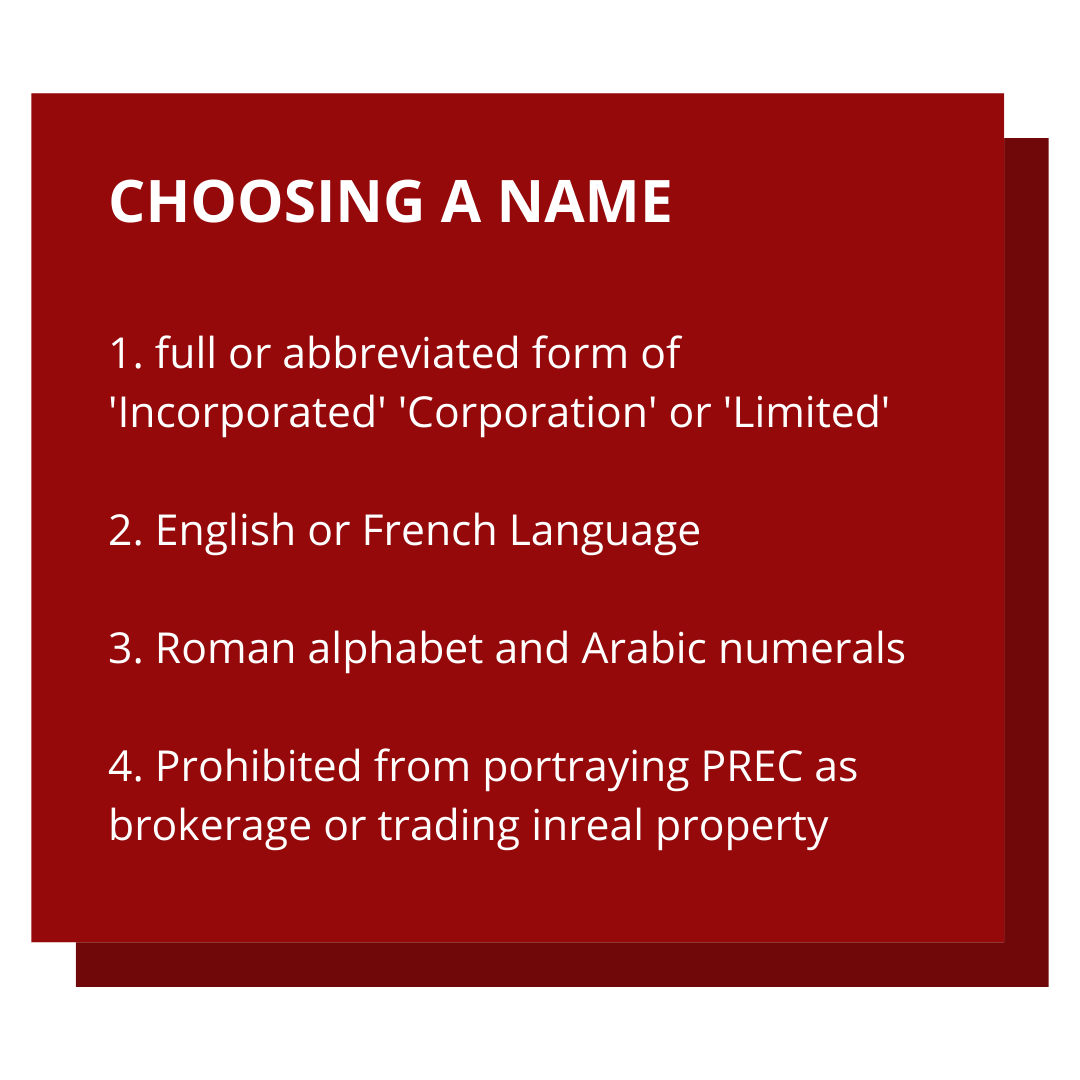

ADVERTISING YOUR REAL ESTATE BUSINESS

New advertising requirements from RECO and REBBA must be strictly adhered to by your PREC. Amendments to REBBAs Code of Ethics allow for some leniency in describing licensed Agents to the public, now permitting the use of the REALTOR® descriptor. Advertising your PREC, however, requires more attention to regulations. Since PRECs cannot represent to the public that they carry on the business of trading in real estate, RECO and REBBA prohibit you from using the name of your PREC in advertisements. Thus, you may need to register a separate Trade Name with the Ministry for advertising purposes.

PREC AUTHORITY AND LIABILITY

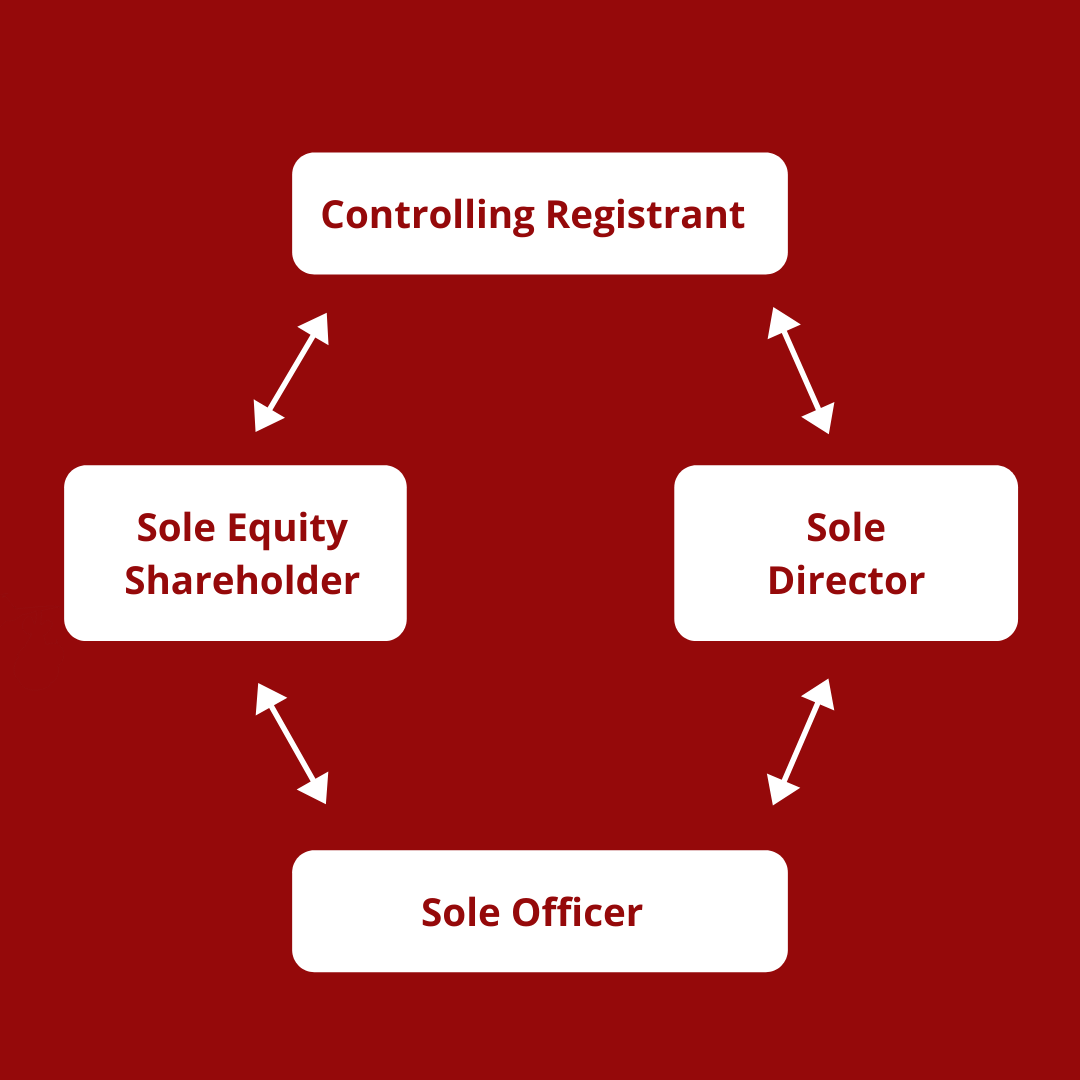

As detailed in Part One, the Controlling Registrant must maintain all powers, title, and authority of your PREC. You hold every applicable office and delegation of any powers, title, or authority is strictly prohibited.

Director Liability

REBBA and OBCA regulate director and officer liability for Ontario PRECs. OBCA permits directors to appoint proxies or committees that may share their powers. However, PRECs are not permitted to such leniency; transfer of the Controlling Registrant’s powers is not permitted. Any provisions, agreements, or otherwise that impede, in whole or in part, the ability for a director/officer to manage or supervise the PREC are strictly prohibited.

Duty of Care

It is important to note that as the Controlling Registrant of your PREC you are subject to the same Duty of Care as Agents. A Duty of Care is the level of obligation owed to your clients. Incorporating your real estate business does not preclude you from following REBBA regulatory obligations and fiduciary responsibilities. As a Controlling Registrant and an Agent, you are expected to exercise the same care and skill to your clients as with your corporate duties. You will need to act in the best interests of your clients and your corporation. This is specifically applicable in the field of financial gain as this is the motive for the majority of PRECs.

For more information on Corporate Liability and Duty of Care, see “Incorporating your Business, Part Two: Corporate Liability” [coming soon].

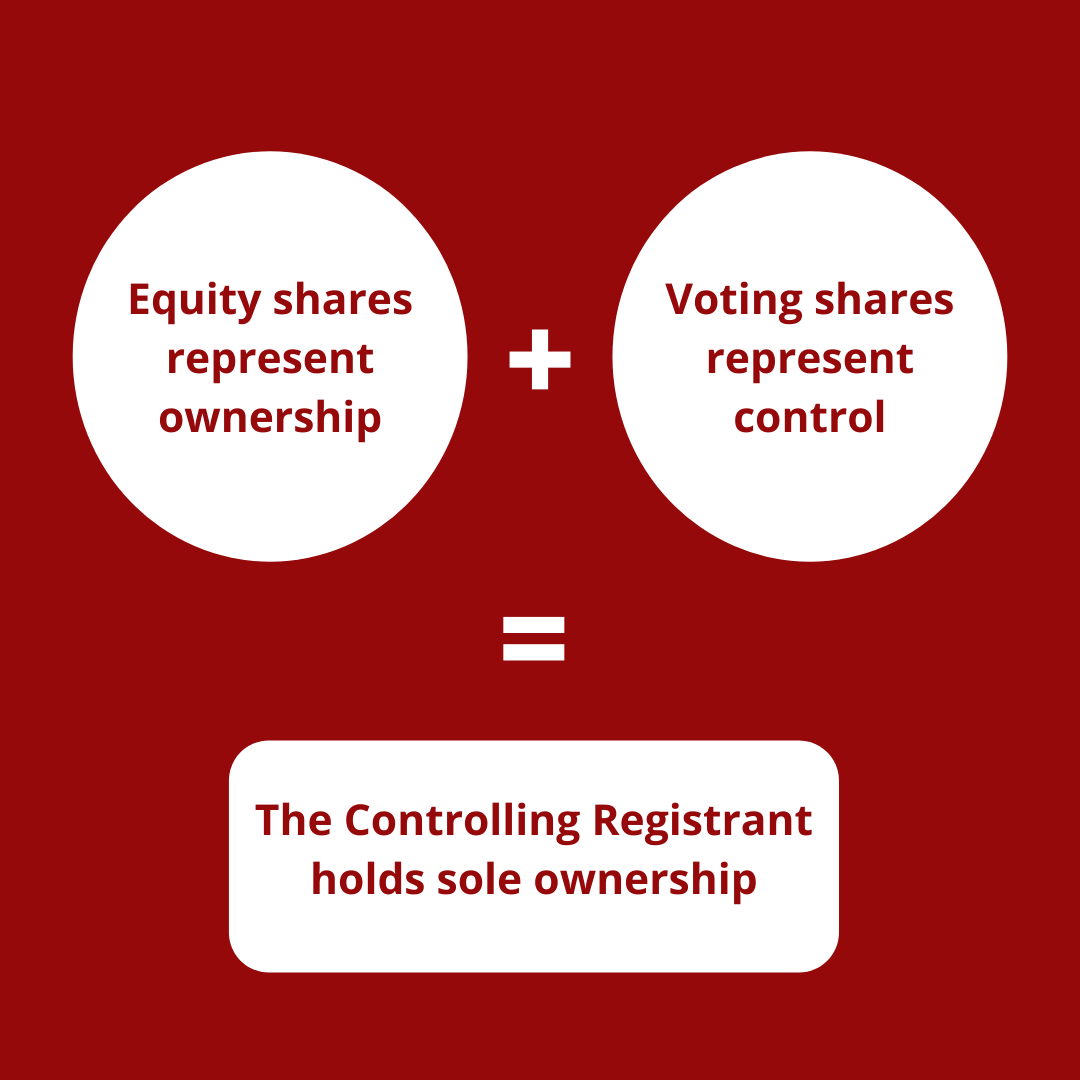

OWNERSHIP, EQUITY & INVESTMENT IN PRECs

Though the Corporation is entitled to issue non-voting shares to family members as per REBBA regulations, only the Registrant is permitted to own shares with voting rights and hold equity in the capital of the corporation. As sole owner of the corporation, you are entitled to invest excess funds at your discretion. But, as PRECs cannot represent themselves to the public as agents or brokers they are strictly prohibited from trading in real property. Nevertheless, your PREC is permitted to partake in passive investments such as holding shares in another corporation or owning land rights and property, provided that your authority and ownership as Controlling Registrant is not undermined.

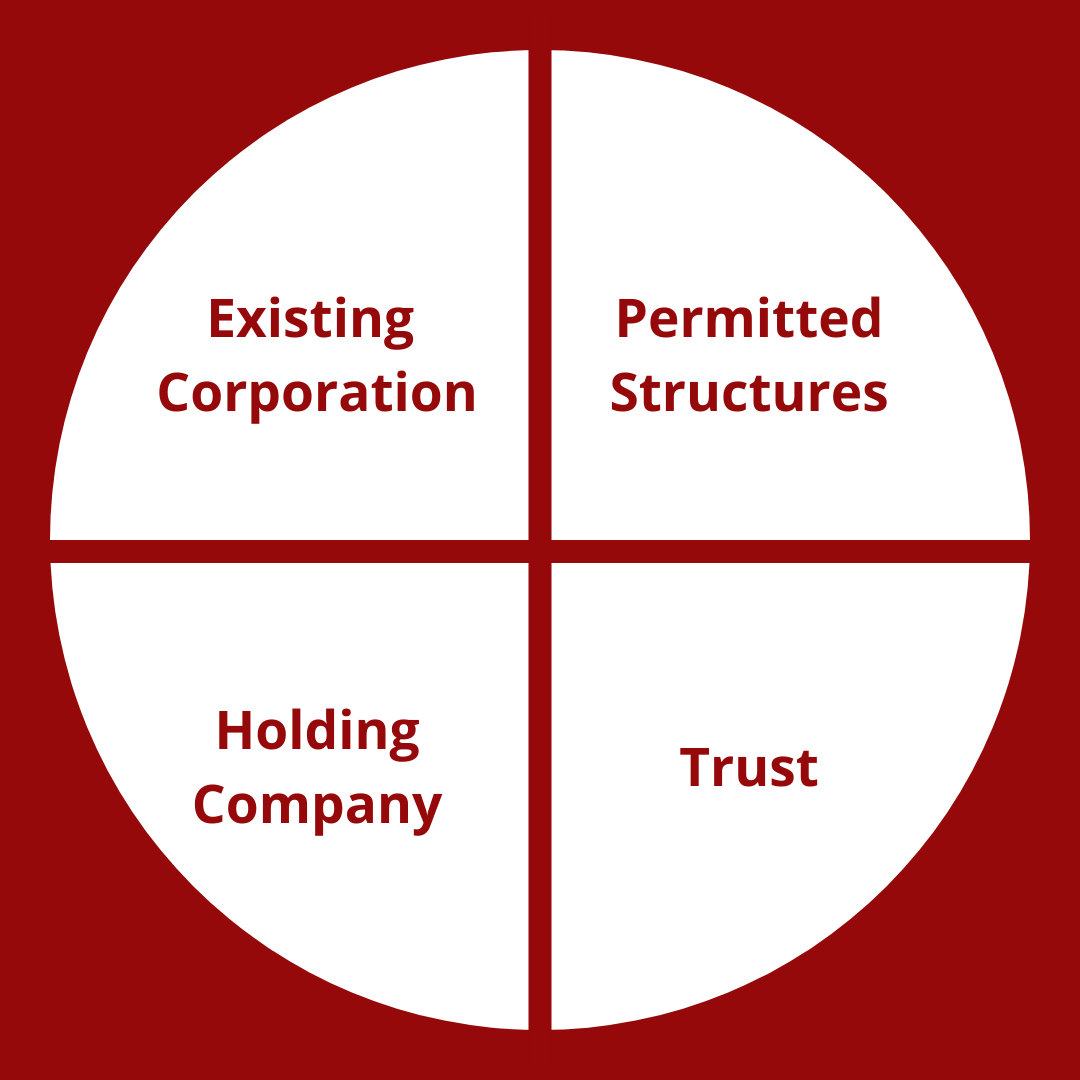

CORPORATE STRUCTURE OF YOUR PREC

There are several avenues to take in constructing your PREC that may be beneficial to the growth and efficiency of your business. Whether this is your first corporation or you are hoping to expand on an existing business, every option has its own pros and cons that need to be explored.

Existing Corporation or Brokerage

For Registrants with an existing Ontario corporation, conversion into or continuance of said company into a PREC is permitted. But, the existing corporation, and its structure, must adhere to both OBCA and REBBA requirements. Before considering this avenue, note that the existing corporation’s history will become fundamentally connected to your PREC upon conversion or continuance. This includes any and all liabilities, finances, investments, etc. Therefore, it may be beneficial to form a separate entity.

REBBA also permits Agents to convert an existing brokerage into a PREC; however, the brokerage would be required to stop trading in real estate immediately. Further, the brokerage would no longer be a Registrant and the closure of such brokerage would require the Agent to follow any regulatory or internal termination requirements. It is highly recommended that you discuss the possibility of converting your existing business with both your financial advisor and a qualified legal representative.

Holding Companies and Trusts

REBBA allows for the Controlling Registrant to hold equity shares directly or indirectly. This means that it is within your authority to hold shares in your PREC as a holding company or trust. But it is important to note that this decision may impact your tax incentives. Both holding companies and trusts are permitted to hold non-equity, non-voting shares in the PREC in accordance with REBBA regulations; however, trusts are not permitted to hold any equity shares given that the Controlling Registrant must both legally and beneficially own all the equity shares.

An affiliated holding company is permitted to own equity shares in your PREC so long as such corporation is structured exactly like your PREC and the Controlling Registrant holds all voting shares and authority. This structure holds several growth possibilities, specifically with respect to future real estate investments and asset protection. As an equity shareholder, your holding company will be able to draw funds from the PREC as a dividend and, in essence, loan such funds back to the PREC as needed.

If you’re ready to take your real estate business to the next level, reach out to our corporate law staff at info@rabideaulaw.ca.

Please note, this article should not be construed as legal advice. You should obtain the advice of your legal representative, financial advisor, and/or accountant prior to incorporating a PREC.

* UPGRADE your package for $200 and we will apply for the corporate tax number, HST number and payroll number.