Personal Real Estate Corporations Part One: What is a PREC?

On October 1st, 2020, Ontario passed legislation, Trust in Real Estate Services Act, 2020 (“TRESA”), allowing licensed real estate salespersons and real estate brokers (“Agents”) to incorporate their business, known as a Personal Real Estate Corporation (“PREC”). With the passing of Bill 145, TRESA replaces the existing Real Estate and Business Brokers Act, 2020.

PRECs will open several doors for Agents and will become a valuable asset to many real estate salespersons. PRECs have the potential to allow for not only an expansion of autonomy over one’s personal finances, but also offers new opportunities in tax planning, holding assets, succession planning and business growth and expansion.

THE PREC AS A SEPARATE LEGAL ENTITY

PRECs, as an incorporated company, are a separate legal entity from the Agent. Meaning, PRECs can generate income, have their own bank account, pay their own income taxes, collect and remit their own HST and can apply for credit. These abilities provide you the opportunity to separate your personal finances from your business. This separate legal entity also means that in most cases, the corporation’s liabilities remain separate from your own, provided you have not signed off as a personal guarantee or encounter liability as a director. For more information on such director liability, we are coming out with a blog shortly called “Personal Real Estate Corporations Part 3: Corporate Structure & Liability.”

HOW DO PRECS WORK?

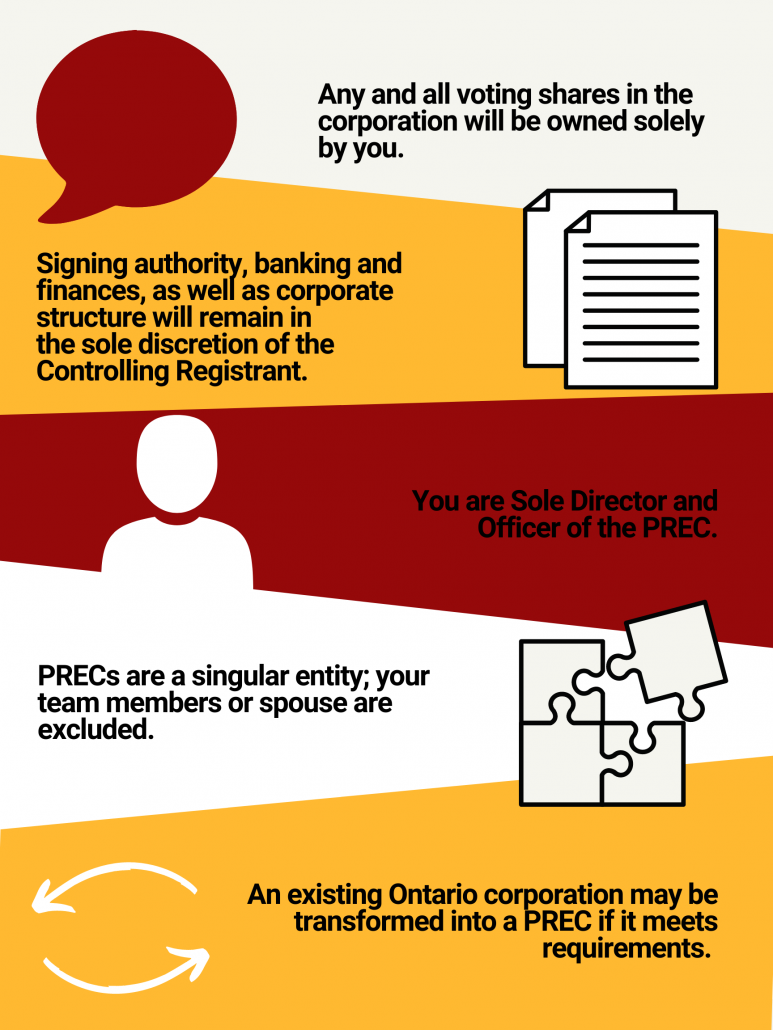

TRESA regulations indicate that PRECs cannot trade in real estate, therefore you, as the licensed salesperson, continue to operate under RECO working with an active brokerage. Just as you have a driver’s licence and use your vehicle to make it to your destination, the PREC operates in the same fashion. You maintain your RECO license and operate through the PREC. The goal is to get you to a desired destination that you could not achieve by walking or being a sole proprietor. There are several requirements and conditions however, one being that you the sole Agent of your PREC. Both in theory and practice you will be the sole shareholder, officer, and director of the PREC. As such, only you will be permitted to make decisions, have signing authority, and hold equity in the corporation. You are the Controlling Registrant.

CONSIDERATIONS & OBLIGATIONS REGARDING YOUR PREC

Every Registrant, as a licensed Agent in Ontario, is provided the opportunity to incorporate but there are some aspects to consider prior to making any decisions. Such considerations may require consulting with other professionals regarding financial and legal matters as well as the existing relationship with your brokerage. For instance, though you do not need to register your PREC with RECO, you and your PREC remain liable for the services that you, as a Registrant, provide. Your PREC will be held accountable by RECO for misconduct, as you would; therefore, consult with your insurance broker to discuss your liability insurance requirements.

BROKERAGE AGREEMENT

In addition to being actively involved with an existing brokerage, Registrants hoping to incorporate are required to ensure said brokerage is in agreement with the terms and conditions of your PREC. TRESA requires that an agreement be entered into between the PREC and your brokerage. There are currently no existing parameters for such agreement, but RECO has provided that the intent is to bind both you, your PREC, and the brokerage. If you or your brokerage requires assistance with drafting this agreement please feel free to reach out to us at info@rabideaulaw.ca.

For more information regarding the financial considerations of your PREC, please see the blog, “Personal Real Estate Corporations, Part Two: Implications and Tax Incentives”.

THINKING OF INCORPORATING?

Our PREC Incorporation Packages start at ONLY $1450+HST* and this includes filing the Articles of Incorporation all necessary searches and the creation of the Minute Book, all share certificates and the necessary initial By-Laws and Resolutions.

If you’re ready to take your real estate business to the next level, reach out to our corporate law staff at info@rabideaulaw.ca.

Please note, this article should not be construed as legal advice. You should obtain the advice of your legal representative, financial advisor, and/or accountant prior to incorporating a PREC.

* UPGRADE your package for $200 and we will apply for the corporate tax number, HST number and payroll number.